5 charts that explain crypto right now

The metrics we're watching, from DEX volume to mobile wallet usage. Plus, the industries where DePIN is making inroads.

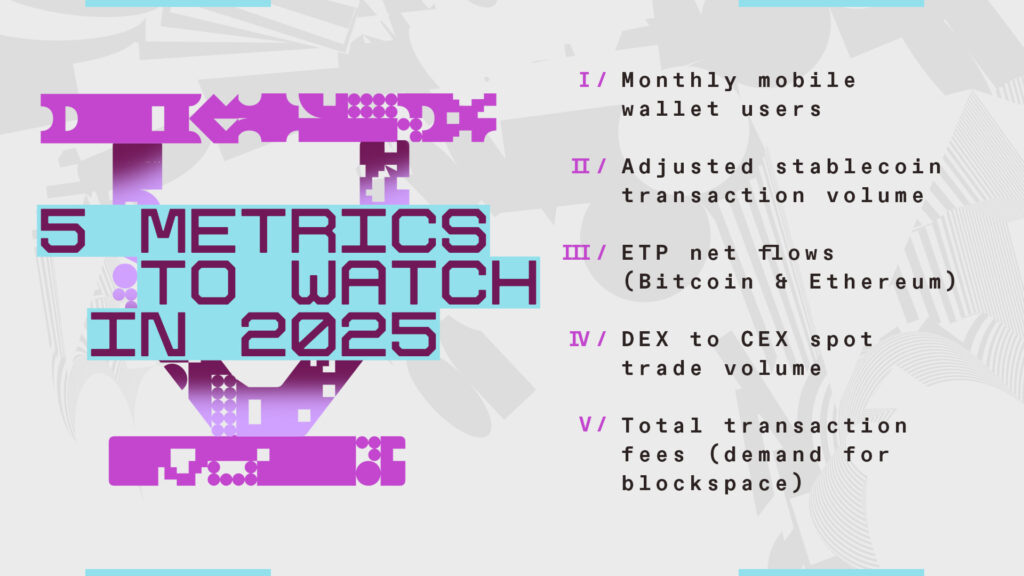

Numbers, news, trends: The 5 crypto metrics we’re watching

Daren Matsuoka and Robert Hackett

From mobile wallet usage and onchain transaction fees to volume across stablecoins, decentralized exchanges (or DEXs), and exchange traded-products (ETPs) — these are the charts our team is looking at most closely to track the market.

We also cover the latest numbers, news, and trends with our resident data weatherman (and author of our flagship State of Crypto reports), Daren Matsuoka, on the latest episode of the web3 with a16z podcast.

read the thread

listen to the podcast

Where decentralized infrastructure (DePIN) is making inroads: 6 promising use cases

Guy Wuollet

DePIN protocols offer a new model for building and operating real-world systems. At this point the term “DePIN” might feel conflated with decentralized energy, but there are many other industry applications.

The throughline connecting them is a path to sunsetting the monopolistic, opaque, and outmoded infrastructure systems we rely on today — and reimagining them as open, permissionless networks that are owned and operated by users. DePIN can lower barriers to entry, incentivize innovation, and distribute ownership and economic rewards across almost any category that relies on massive systems of physical infrastructure.

But how is DePIN actually playing out across real-world use cases? What progress have builders made so far? And what’s left to explore? Here are six categories — energy, telecom, transportation, AI, robotics, and healthcare — where DePIN is already making inroads, and where we may be headed next.

And more DePIN insights…

Members of the a16z crypto research lab published a new paper showing for the first time that those trying to verify DePIN protocols face two — and only two — fundamental challenges: manipulation and self-dealing. They also offer suggestions for how to overcome them.

Answering FAQs on the end of the foundation era

Miles Jennings

Calling for an end to crypto’s offshoring in our recent article “The end of the foundation era in crypto” sparked some debate. In this post, a16z crypto Head of Policy Miles Jennings address five of the most commonly asked questions, including…

What about tax?

“Offshore foundations can offer tax benefits, but there’s more risk here than many people think (and more than advisors are willing to admit). Most founders we talk to would, in retrospect, gladly give up the tax efficiencies they gained through offshoring to eliminate the overhead those structures create.

Is there a role for foundations going forward?

Definitely. The main point of the piece wasn’t “no foundations ever” — it was that we should stop using them for decentralization theater. Market structure legislation forcing that change is a good thing.

Foundations (especially domestic ones) with focused mandates — like executing grant programs and coordinating ecosystem-wide efforts — will continue to be useful.

Updates from DC: GENIUS passes the Senate

The GENIUS Act — the first comprehensive crypto regulatory framework in the United States — passed the U.S. Senate in a bipartisan vote on Tuesday afternoon. As a16z crypto founder and general partner Chris Dixon wrote: “This stablecoin bill protects consumers and gives entrepreneurs the guardrails they need to drive innovation and economic growth in crypto and beyond. Now we need comprehensive market structure legislation so the US can lead in building blockchain networks.”

— a16z crypto editorial team

You’re receiving this newsletter because you signed up for it on our websites, at an event, or elsewhere (you can opt out any time using the ‘unsubscribe’ link below). This newsletter is provided for informational purposes only, and should NOT be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites or other information obtained from third-party sources — a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. Furthermore, the content is not directed at nor intended for use by any investors or prospective investors in any a16z funds. Please see a16z.com/disclosures for additional important details, including link to list of investments.