5 (more) charts that explain crypto right now

The metrics that defined the industry this year

IN THIS EDITION:

The data behind the stablecoin surge and four more metrics that explain crypto right now

What’s different about measuring growth in crypto — which metrics no longer apply and which need to be adapted

The a16z crypto team talks State of Crypto 2025

Stablecoins meet IRL payment rails

As we start looking back on 2025, here are five of the metrics that defined the industry this year, from stablecoin transaction volume to developer activity and blockchain throughput.

And for more key indicators, check out our State of Crypto dashboard, which we released last week.

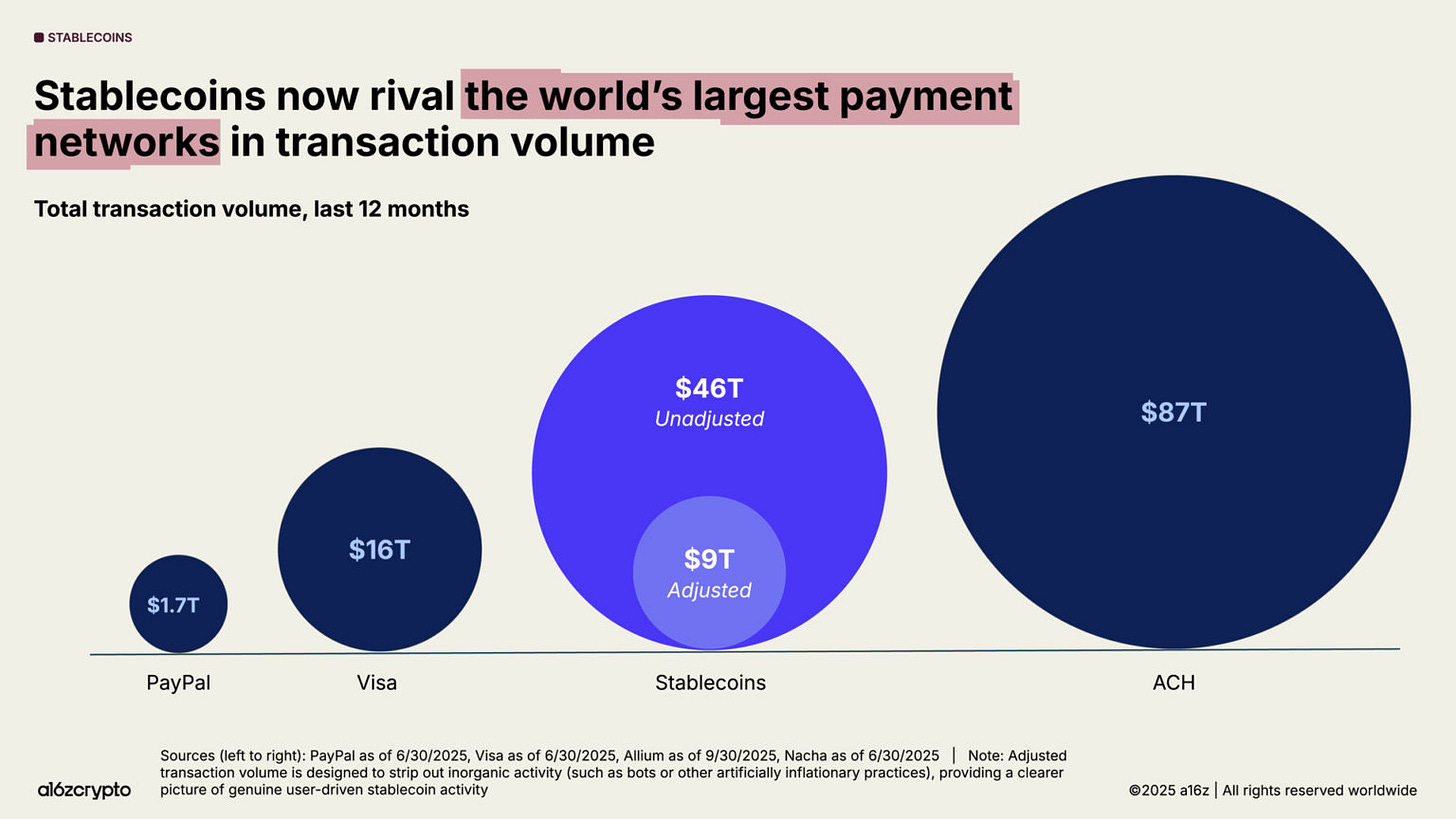

Stablecoins are doing trillions in transaction volume

Stablecoins have become a global macroeconomic force.

They’ve done $46 trillion in total transaction volume in the last year, up 106% from the year before. That’s nearly 3x that of Visa’s transaction volume, and is approaching the volume of the ACH network that plumbs the entire U.S. banking system.

While these are not apples-to-apples comparisons, the sheer volume highlights just how large this trend has become. (The stablecoin figures mostly represent financial flows versus retail payments for card and other networks.)

A better measure of organic activity looks at adjusted stablecoin transaction volume, which filters out bots and other artificially inflationary activity. On this basis, stablecoins have done $9 trillion in volume in the last 12 months. This is more than 5x PayPal’s throughput.

It’s worth noting that stablecoin volume is now mostly uncorrelated with broader crypto trading volume, which suggests that stablecoins have found organic use cases and product-market fit beyond crypto market activity.

So why have stablecoins exploded so quickly in size and popularity? Head of Data and Fund Strategy Daren Matsuoka explains:

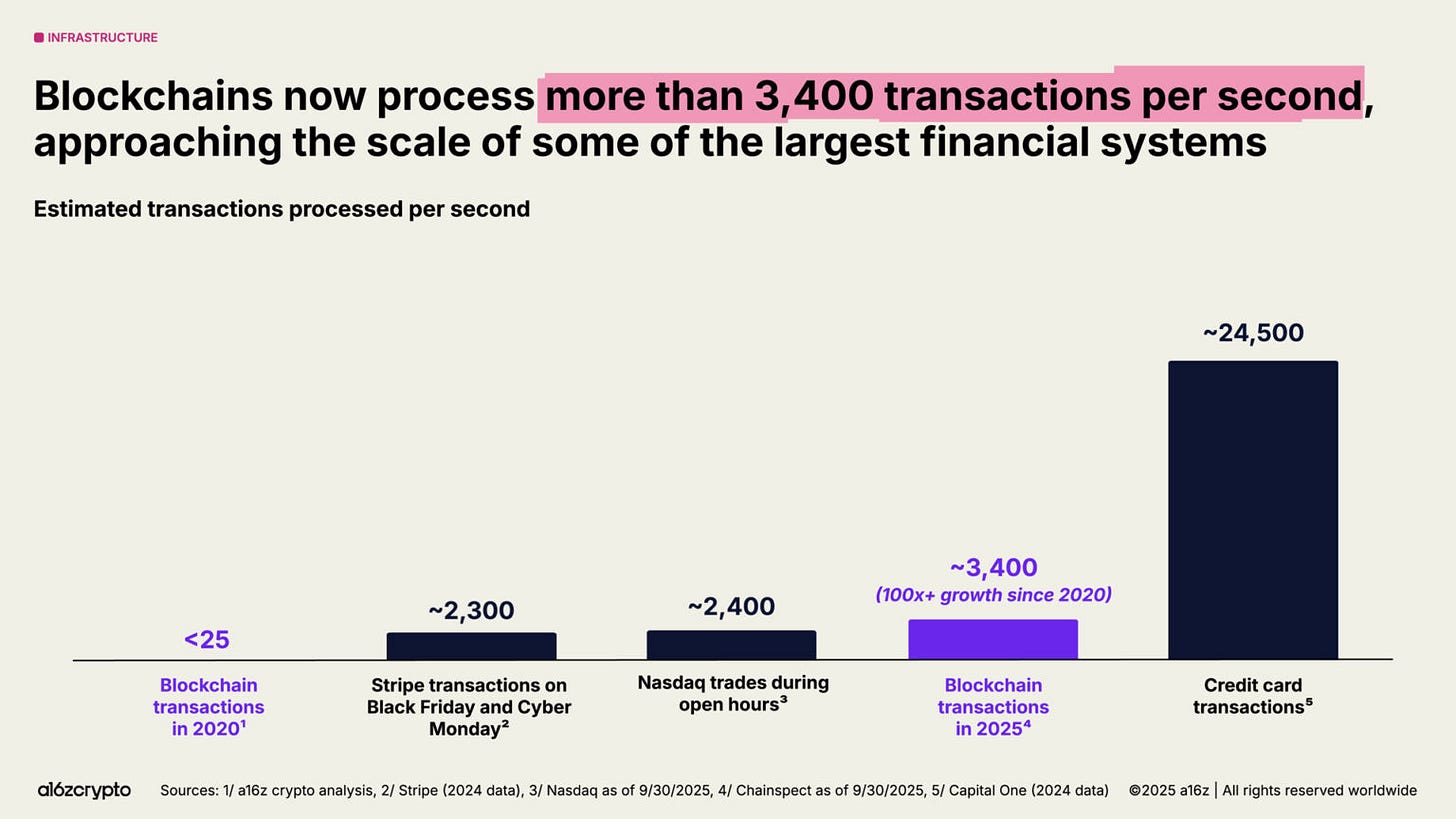

Blockchains can process more than 3,400 transactions per second

In just five years, aggregate transaction throughput across major blockchain networks has increased more than 100x.

Back then, blockchains processed fewer than 25 transactions per second. Now they process 3,400 transactions per second, which is on par with Stripe’s global throughput on Black Friday — at a fraction of the historical cost.

Solana’s high-performance, low-fee blockspace now underpins everything from DePIN projects to NFT marketplaces, with its native applications generating $3 billion in revenue in the past year.

As Ethereum continues to execute on its scaling roadmap, most of its economic activity is migrating to L2s. Average transaction costs on L2s have dropped from around $24 in 2021 to less than one cent today.

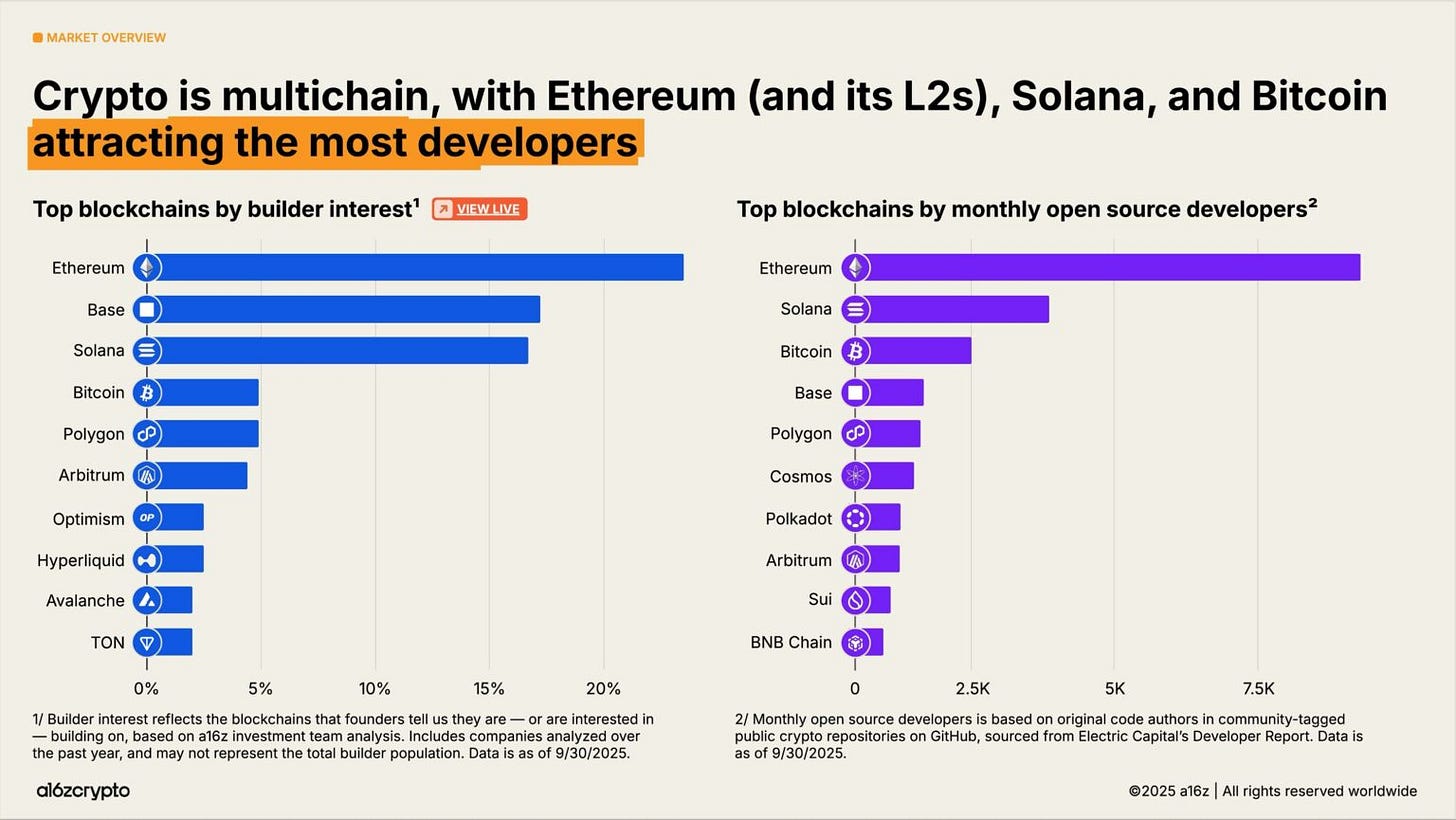

Ethereum, Solana, Bitcoin, and Base are attracting the most developers

Ethereum and its L2s were the top destination for new builders in 2025.

Meanwhile, Solana is one of the fastest-growing ecosystems, with builder interest increasing by 78% in the last two years. This analysis from the a16z crypto investment team is a reflection of the number of founders who tell us which ecosystem they are building on or are interested in building on.

You can take a closer look at how these trends are changing over time in the State of Crypto dashboard.

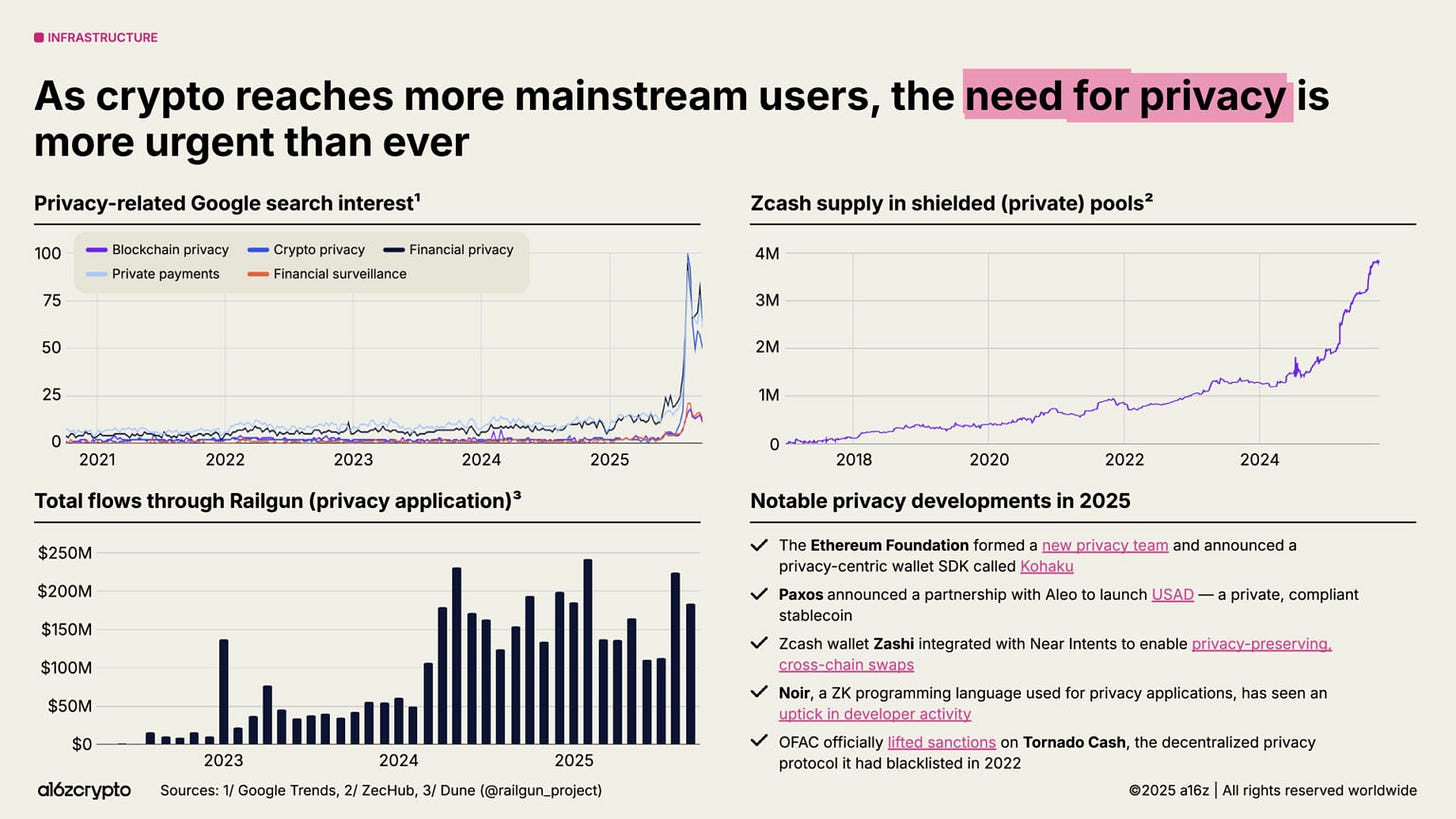

Users want more privacy

Here are a few indicators of growing interest and momentum:

Google searches related to crypto privacy surged in 2025

Zcash’s shielded pool supply grew to nearly 4 million ZEC

Railgun’s transaction flows surpassed $200 million monthly

The Ethereum Foundation formed a new privacy team

Paxos partnered with Aleo on a private, compliant stablecoin (USAD)

The Office of Foreign Assets Control lifted sanctions on decentralized privacy protocol Tornado Cash

We expect this trend to gain even more momentum as crypto continues to go mainstream. For more, here’s a16z crypto CTO Eddy Lazzarin on why blockchain privacy is more urgent than ever:

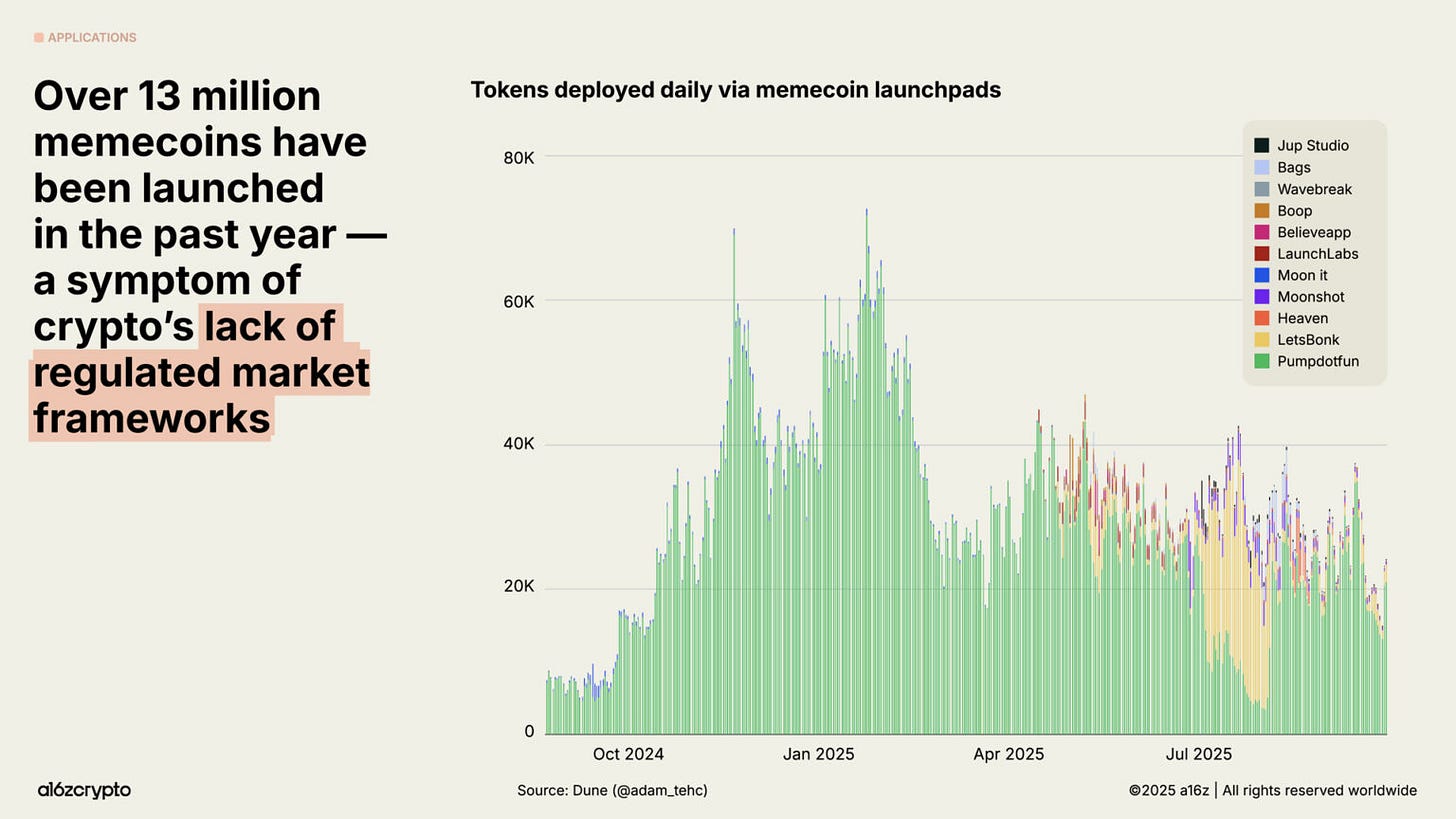

13 million memecoins launched in the last year

More than 13 million memecoins launched in the last year on Solana memecoin launchpads.

A lack of regulatory clarity in the U.S. may have contributed to this surge. During the last administration, it was arguably safer to launch a memecoin than to build a crypto company or create a productive token.

This trend appears to be cooling down in recent months: There were 56% fewer launches in September than in January.

Which metrics matter most?

What metrics are we tracking in 2025? Here are 5 metrics to watch and how they’ve evolved this year.

What’s different about crypto growth metrics? Here are the metrics that are unique to crypto, which metrics no longer apply, and which need to be adapted.

AROUND THE WEB

Investing is a test of conviction and patience

Chris Dixon on TPBN

Investing is an emotional test disguised as an intellectual one, says a16z crypto Founder and Managing Partner Chris Dixon. In his recent TPBN interview, he also talks about why institutions have shifted from doubt to adoption; how AI, robotics, and crypto are reinforcing “megatrends”; and more.

Inside the 2025 State of Crypto Report

Daren Matsuoka and Robert Hackett on Milk Road

What’s the state of the crypto industry? In short: it’s growing up. As a16z crypto’s Daren Matsuoka and Robert Hackett discuss on Milk Road’s podcast and newsletter, DeFi now accounts for 20% of spot crypto trading; companies like Stripe, Visa, and PayPal are launching real products; and AI is emerging as a complementary force — from identity to agentic payments to decentralized compute.

The price-innovation cycle: Where are we now?

Daren Matsuoka and Eddy Lazzarin on Bankless

Why did ETFs and memecoins lead the market rally of 2024? What’s different about this cycle? And will the next phase of crypto be developer-driven? Daren and Eddy argue yes on this Bankless podcast. With blockchains now capable of processing 3,400 transactions per second, the bottlenecks are shifting from throughput and scalability to user experience and regulation.

NEWS AND UPDATES

Stablecoins meet IRL payment rails

One of the biggest legacy payments networks is now embracing blockchain rails for real-world money movement: Western Union just announced plans to launch its own U.S. dollar-backed stablecoin (USDPT) — built on Solana and issued by Anchorage Digital Bank — alongside a new Digital Asset Network that connects crypto to cash through its global retail and banking partners. It’s designed to make cross-border transfers fast, cheap, and accessible — especially in emerging markets — while leveraging recent regulatory clarity around stablecoins.

Meanwhile, payments processor Zelle announced that it will be using stablecoins for international transactions to “deliver faster and more reliable cross-border money movement,” the parent company said.

— a16z crypto editorial team

You’re receiving this newsletter because you signed up for it on our websites, at an event, or elsewhere (you can opt out any time using the ‘unsubscribe’ link below). This newsletter is provided for informational purposes only, and should NOT be relied upon as legal, business, investment, or tax advice. This newsletter may link to other websites or other information obtained from third-party sources — a16z has not independently verified nor makes any representations about the current or enduring accuracy of such information. Furthermore, the content is not directed at nor intended for use by any investors or prospective investors in any a16z funds. Please see a16z.com/disclosures for additional important details, including link to list of investments.

Neobanks will push that even further. I rarely use my bank cards and rely on apps like Etherfi or kast to simply make purchases now